On Thursday, Cisco made headlines by announcing its intent to buy Splunk, a renowned cybersecurity software company, at $157 per share. This all-cash transaction, estimated at around $28 billion, marks the most significant acquisition in Cisco’s history.

Following the news, Splunk’s shares surged by 21%. Meanwhile, Cisco experienced a 4% decline in share price.

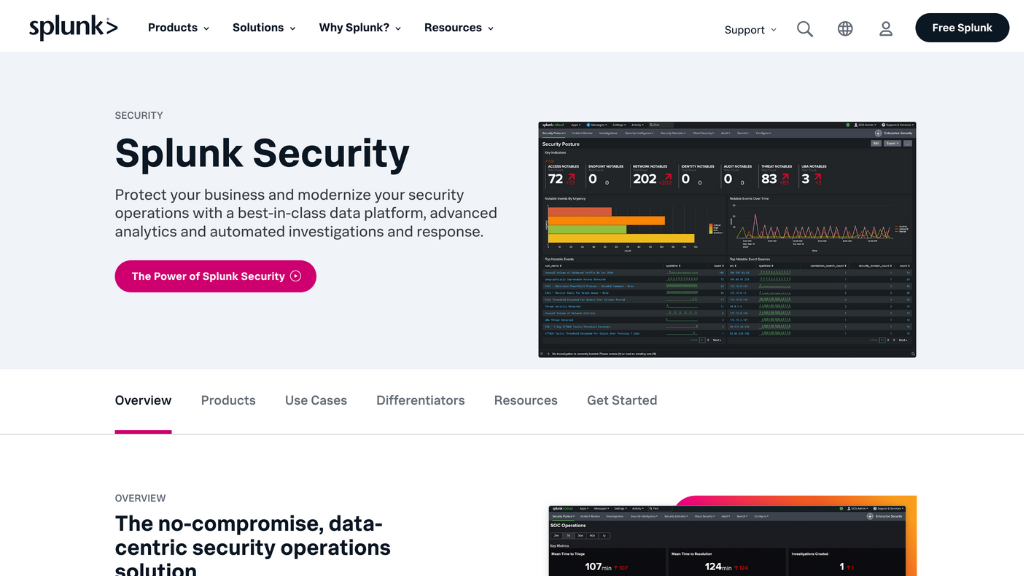

Splunk is celebrated for its unique technology that empowers businesses to track and evaluate their data. This aids in significantly reducing hack risks and allows companies to troubleshoot technical issues more swiftly. Cisco, a global leader in computer networking equipment, is keen to augment its cybersecurity segment. This move aligns with their goal to meet growing consumer demands and ensure sustainable growth.

Chuck Robbins, Cisco’s CEO, underscored the revolutionary role of artificial intelligence in enhancing network security. Highlighting Splunk’s AI capabilities, Robbins commented, “Together, our technologies will shape the future of AI-driven security and observation. This partnership aims to shift from mere threat detection to anticipating and averting threats, ensuring robust security for organizations of varying scales.”

Also Read: GitHub Embraces Device-Linked Passkeys for a More Secure User Experience.

The agreement is slated to finalize in the third quarter of 2024. Cisco is optimistic about the acquisition bolstering its gross margins in the inaugural year, with non-GAAP earnings witnessing an uptick in the following year.

Relative to its market cap, Cisco’s investment in Splunk accounts for about 13%. Historically, Cisco has been cautious about mega-deals. Before Splunk, Cisco’s most substantial acquisition was the $6.9 billion procurement of Scientific Atlanta, a cable set-top box manufacturer, in 2006.

As public cloud adoption disrupts Cisco’s conventional backend business, the company has been scouting for impactful revenue avenues, with cybersecurity emerging as a prime focus. Consequently, Cisco transitioned its core business name from “Infrastructure Platforms” to “Secure, Agile Networks” in fiscal 2022, spotlighting the pivotal role of embedded security in network devices.

For the fiscal year concluding on July 29, the core segment reported a 22% growth, accumulating $29.1 billion, while the dedicated security division observed a 4% surge in sales, reaching $3.9 billion.

Despite these strides, Cisco’s shares have lagged behind the Nasdaq, witnessing only a 12% appreciation this year compared to the tech-dominated index’s impressive 27% growth.

Robbins conveyed his optimism about the synergistic potential between Cisco and Splunk to CNBC, predicting that the benefits of this alliance will manifest within 12 to 18 months. The acquisition will be financed through a blend of cash and borrowing.

Gary Steele, Splunk’s CEO, who will be integrating into Cisco’s leadership post-acquisition, countered these concerns. He emphasized the undiminished relevance of their on-premises solutions for many sizable clients.

Splunk welcomed Steele as its CEO just over a year ago. His previous stint was at Proofpoint, a cybersecurity entity acquired in 2021 by Thoma Bravo for $12.3 billion.

If unforeseen challenges derail this acquisition or if regulatory bodies disapprove, Cisco is bound to remunerate Splunk with a $1.48 billion termination fee. Conversely, if they retract from the deal, Splunk would owe Cisco $1 billion.

0 Comments