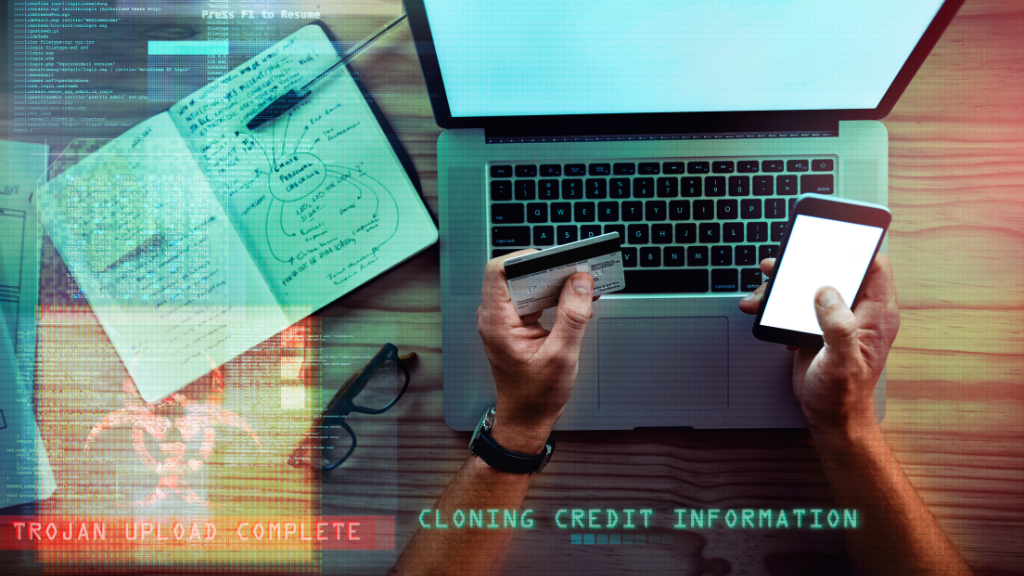

As the digital landscape expands, so does the sphere of credit card transactions. While this digital transformation brings about many conveniences, it raises novel threats, particularly credit card fraud. The need for robust credit card fraud detection has become more paramount than ever before.

This post is a comprehensive guide to understanding and identifying fraudulent activity, protecting yourself from potential fraudsters, and enhancing your credit card security.

Credit Card Fraud Detection: A Crucial Necessity

Credit card fraud can result in devastating financial losses for consumers and institutions. So, how can credit card fraud be detected? Primarily through comprehensive detection systems that monitor suspicious activities, identify fraud patterns, and mitigate risks effectively.

Also See: Google Password Manager vs Bitwarden: Which to Choose in 2023

The Red Flags of Credit Card Fraud

Regarding credit card fraud detection, there are several warning signs to watch for. Unfamiliar transactions can be a red flag, even for small amounts, as fraudsters often test the waters with small purchases before making larger ones. Receiving credit cards you didn’t apply for or not receiving bills or other mail can also indicate that a fraudster is diverting your mail to another address. Always stay alert to these signals as they may suggest your credit card security is compromised.

How AI and Machine Learning Help in Detecting Fraud

AI and machine learning have become vital tools in credit card fraud detection. These technologies can analyze large volumes of data and find out patterns that may indicate fraudulent activity. For instance, AI can flag this as potentially fraudulent if a card is used in two countries within a short time frame.

Machine learning algorithms are constantly learning and adapting to new fraud tactics. This adaptability makes them an invaluable asset in the fight against credit card fraud. Machine learning models can quickly analyze thousands of transactions and accurately detect any anomalies that could indicate potential fraud.

Other Technological Measures for Fraud Detection

Besides AI and machine learning, other technological measures help in fraud detection. These include multi-factor authentication (MFA), encryption, tokenization, and behavior analytics.

Multi-factor Authentication

MFA offers an additional layer of security that need users to give two or more authentication factors to access a resource like an application, online account, or VPN.

Encryption and Tokenization

Encryption converts cardholder data into a code to prevent unauthorized access. On the other hand, tokenization replaces sensitive cardholder information with a unique identifier (token), rendering it useless if intercepted by fraudsters.

Behaviour Analytics

This technology uses big data analytics to detect abnormal behaviour or deviations from usual spending patterns, flagging these anomalies for further investigation.

Credit Card Fraud Prevention: How Can You Protect Yourself?

While financial institutions do their part to detect and prevent credit card fraud, there are steps that you, as a consumer, can take to protect yourself. Knowledge is power, and safeguarding your credit card information is the first defence against fraud.

Regular Monitoring of Your Accounts

As mentioned earlier, regularly checking your accounts can help you spot any irregularities that may indicate fraud. Many banks offer mobile banking apps that allow you to check your account activity anytime, anywhere.

Safe Online Shopping Practices

With increasingly increasing online shopping, practising safe online shopping is vital. Always use a secure website (https://) when purchasing online. Be wary of deals that seem too good to be true—they often are.

Be Cautious of Phishing Attempts

They often come in the form of emails or text messages that seem to be from your bank or credit card company. Always be cautious when you receive messages asking for personal information or credit card details. Remember, legitimate organizations never ask for sensitive information via email or text.

The Power of Strong, Unique Passwords

Having strong and unique passwords for online accounts is an easy and excellent method to prevent unauthorized access. A strong password includes upper and lower-case letters, numbers, and special characters. Avoid using obvious choices like “123456” or “password.”

Taking Advantage of Card Issuer’s Security Features

Many credit card issuers offer additional security features, such as temporary card numbers for online purchases or the ability to freeze your card if it’s lost or stolen. Make sure to familiarise yourself with these features and take advantage of them.

Conclusion

Credit card fraud is an alarming reality in our digital age. With knowledge and vigilance, we can play an active role in detecting and preventing it. Remember, knowledge is power! However, while technology is advancing, so are the techniques used by fraudsters, necessitating continuous upgrades, and innovation in fraud detection strategies.

Against this backdrop, expert cybersecurity firms like Nextdoorsec have become even more pivotal. With their cutting-edge solutions and seasoned expertise, they ensure robust and proactive defense against credit card fraud, thereby securing your financial transactions.

FAQs

1. How is credit card fraud detected?

You can detect credit card fraud by using a variety of methods, including monitoring for unusual purchasing patterns, checking for transactions from unfamiliar locations, and verifying transactions that deviate from a cardholder’s typical behavior. Financial institutions also use sophisticated algorithms and machine learning techniques to analyze transaction data in real-time and flag suspicious activities.

2. What is the best algorithm for credit card fraud detection?

There isn’t a single “best” algorithm for credit card fraud detection as it depends on the specific application and data. However, machine learning algorithms like Random Forest, Neural Networks, Logistic Regression, and Anomaly Detection techniques are commonly useful due to their effectiveness in identifying patterns and anomalies indicative of fraud.

3. What are the problems with credit card fraud detection?

Problems with credit card fraud detection include false positives (legitimate transactions flagged as fraudulent), adapting to new types of fraud, maintaining user privacy, and the challenge of real-time detection. Additionally, fraudsters continuously evolve their tactics, making it a constant challenge to stay ahead of new fraud methods.

4. How is credit card fraud detected using machine learning?

Machine learning detects credit card fraud by analyzing vast amounts of transaction data to identify patterns and anomalies that suggest fraudulent activity. Algorithms learn from historical fraud data to recognize suspicious behaviors, such as unusual transaction amounts, a rapid succession of transactions, or transactions from a new location and can adapt over time to detect new types of fraud more effectively.

5. How can Python be used for credit card fraud detection?

You can use Python for credit card fraud detection by employing its various data analysis and machine learning libraries, such as Pandas, Scikit-learn, and TensorFlow. These tools allow for processing and analyzing transaction data building and training models to identify fraudulent activities.

6. What does a credit card fraud detection project entail?

A credit card fraud detection project typically involves collecting and preprocessing transaction data, selecting appropriate algorithms, training a model to identify fraudulent transactions, and testing its accuracy. It may also include implementing real-time fraud detection systems.

7. Can credit card fraud detection be done online?

Yes, you can do credit card fraud detection online using real-time analysis systems that monitor transactions as they occur. These systems use algorithms to instantly evaluate the risk of fraud and flag suspicious activities.

8. What is ‘credit-card-fraud-detection GitHub’?

‘credit-card-fraud-detection GitHub’ likely refers to repositories on GitHub where developers and data scientists have shared their code and projects related to credit card fraud detection. These repositories can include scripts, algorithms, and documentation on implementing fraud detection systems.

9. How is machine learning used in credit card fraud detection?

Machine learning in credit card fraud detection involves training models on historical transaction data to recognize patterns and anomalies indicative of fraud. Techniques like neural networks, decision trees, and anomaly detection are useful to predict and identify fraudulent transactions.

10. What is a credit card fraud detection dataset?

A credit card fraud detection dataset is a collection of transaction data. It is helpful to train and test machine learning models for fraud detection. These datasets typically include various transaction details like amount, time, and whether the transaction was fraudulent.

11. How is Kaggle used for credit card fraud detection?

Kaggle is a platform that hosts competitions and provides datasets for data science projects, including credit card fraud detection. Users can access real-world datasets, use Kaggle’s coding environment, and collaborate with others to develop and benchmark fraud detection models.

12. What is involved in a credit card fraud detection final-year project?

A final-year project on credit card fraud detection usually involves researching current methods, selecting a suitable dataset, applying machine learning algorithms to detect fraudulent transactions, and possibly developing a prototype or software application that demonstrates the project’s findings.

0 Comments